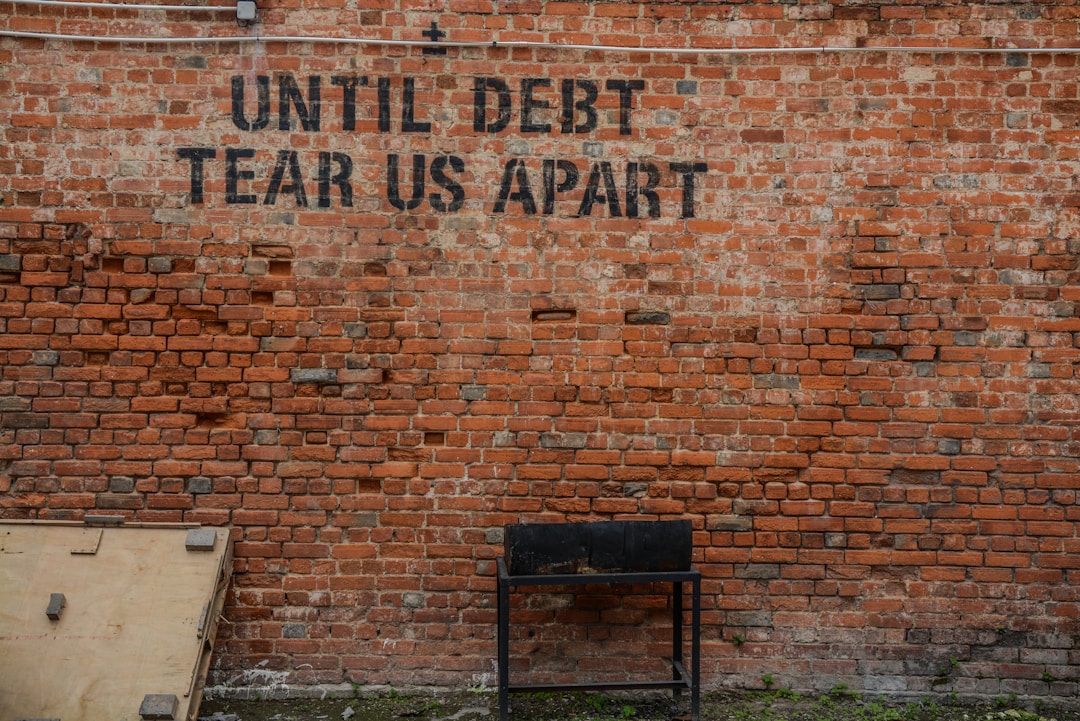

Mental health can be severely impacted by increased levels of debt. There’s just no getting around the fact that debt and stress go hand in hand. In fact, debt accounts for the vast majority of trouble relating to stress in the average U.S. home.

Your health can be severely impacted by the introduction of debt into the routine bills and spending needs of a household, but there are ways to cope with these issues and get out ahead of the stress that debt can cause. With these powerful approaches to managing and mitigating debt and its mental strain, gaining control of your financial health and your livelihood is far easier.

Tackle debt head-on for effective relief.

One of the most important things that you can do as a part of the cohort of Americans who are finding themselves increasingly in debt is to evaluate the wide variety of debt consolidation options that are available to you. Debt consolidation is the best way to approach any mounting debt burden because the persistence of credit card bills, medical expenses, and student loans doesn’t diminish just because a strain is placed on your mental health. If anything, these become more taxing as their weight builds on top of you.

Approaching debt is all about understanding repayment structure, though. With a debt resolution partner like Citizens Debt Relief, making the first steps toward greater financial control is easy and seamless. Consolidating debt in one location can help you manage repayments with ease and even give you a lower monthly payment requirement. This can help you prioritize higher-interest debts or save some cash back for emergency funding needs or even a purchase for yourself. Debt relief is a mindset, and learning to control spending while structuring your repayments in a way that works for you rather than the banks is the first line of defense when it comes to making the most of your finances.

Talk to the right therapist for tailored help with your debt-related stress.

Stress is a difficult thing to pin down. While relieving the tension of your monthly payments can go a long way to providing the reduction in stress levels that you need and deserve, there are other steps that may help you to get moving in the right direction faster. A therapist is a great option for anyone struggling with mental health issues, including stress caused by debt. A provider search tool like WithTherapy can be the difference-maker in your life if you let it be. Searching for a mental health professional for your needs can seem like a significant challenge when you first start the process, but with a great platform for finding and connecting with therapists, counselors, and other mental health professionals, this can be made far easier. This gives you the help you need in a hurry so that you can begin to dissolve the stress and strain that has taken hold of your financial and personal life for so long.

Debt relief and the stress and mental health troubles that come alongside debt itself are important considerations for all consumers these days. With more and more credit cards and other credit accounts making their way into the routine lifestyles of American households, understanding debt and how it can be managed responsibly is essential. The stress that money worries can cause is intense. Utilize some of these resources to help get over these troubles and move into a brighter future for you and your family. Consider a therapist and debt relief solution today for the best possible transition into financial health and stability now.